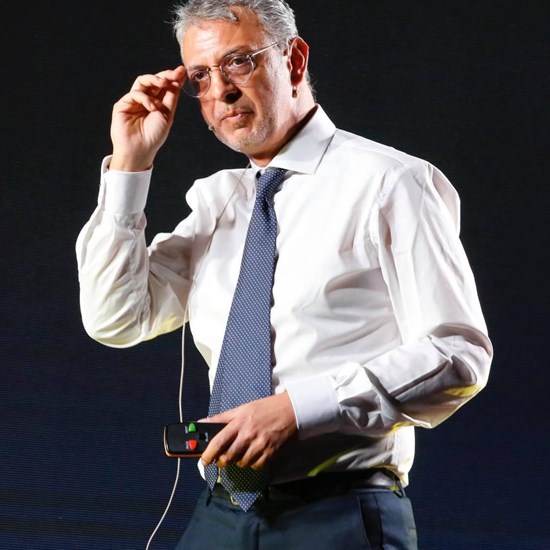

The Revenue Agency has provided clarifications regarding utility tokens, shedding light on the tax aspects to be considered. We discussed this with the team from Daniele Marinelli’s blog, an Italian entrepreneur, CEO, and founder of DTSocialize, an innovative holding that aims to be a pioneer in the protection and enhancement of online data.

Utility Tokens: what are they

Utility tokens are tokens created to offer both specific services to their owners and preferential treatment compared to others. Often, companies benefit from these tokens to create hype and value for a particular product or service. Unlike security tokens, holders of utility tokens are not offered ownership in the company that issued them; therefore, their function cannot be defined as an investment opportunity. Additionally, these tokens constitute a significant portion of all tokens issued in Initial Coin Offerings (ICOs), which, in turn, represent a different type of financing born from blockchain technology and mainly used by startups aiming to realize a specific project.

Clarifications from the Revenue Agency regarding Utility Tokens

Once the meaning and functioning of utility tokens and the value of the Ushare token are clarified, we can move on to the clarifications from the Revenue Agency. According to the agency, the same tax regulatory framework that applies to vouchers should not be applied to utility tokens. This clarification arose from a query by a company that protects copyright by notarizing it on the blockchain to ensure its unalterability. The company’s intention, to raise funds needed to complete its technological infrastructure and cover expenses, is to start an ICO by issuing utility tokens, allowing them to deposit their music at a favorable price.

The precedent of the European Commission

In the past, on December 2, 2019, and June 12, 2020, during VAT Committee meetings, the European Commission had expressed strong doubts about classifying utility tokens within the voucher regulations. According to the European Commission, the voucher regulations do not apply to utility tokens because, after issuance, their nature changes to become:

- A virtual currency.

- An investment instrument, tradable in the secondary market for profit (so-called hybrid token).

Conclusions

In conclusion, Daniele Marinelli of uShare marketing stated that, according to the Revenue Agency, since utility tokens have a dual function (originating as financing tools and transforming into payment methods for discounted services), the same VAT treatment reserved for vouchers during ICOs cannot be applied.